Do my clients want to know what my compensation is?

Do my clients want to know what my compensation is?

Our governing body, Canadian Life and Health Insurance Association (CLHIA) was involved in a proposal called G19. The reason behind this was to get the Insurance Companies to communicate directly with our clients all of our compensation. For Group Benefits, this includes, but is not restricted to: any Compensation paid in relation to premiums or claims paid; bonuses; marketing allowances; transition allowances; sponsorships; and travel and conference incentives.

The article is from Benefits Canada and explains that CLHIA is not continuing with the G19 and is looking into other avenues for Brokers to be transparent with their compensation.

I do understand the reasons behind this. They want to ensure that we are putting our client’s needs ahead of our own. I know that whenever I mention to my clients the compensation I receive, it normally ends up being an embarrassing moment. I think it is because most businesses don’t tell their clients the money they are making when a product is purchased from them. We all assume that money is being made and that the person making it has expenses.

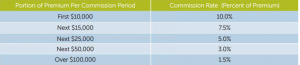

In saying that, I am happy to share any information my clients would like regarding compensation. I take a Standard Compensation (commission) and I have always done that. Insurance Companies normally pay on a graded scale, so the more premium received or the larger the group, the less the compensation. For example, and not limited to:

One way to see if a broker is taking more or less than Standard Commission is in the Target Loss Ratio (TLR) or sometimes described as the Administration Cost. If the TLR seems higher than normal, this might be because the Broker has added additional compensation. This trick does not always work between different Insurance Companies, since each Company has their own unique expenses.

So at the end of it all, please feel free to ask me and I will be happy to talk to you about my Compensation.

If you want to work with a broker who offers transparency, contact Glendinning Insurance Services.